It’s pretty hard to buy a house right now. COVID-19 has sent the housing market skyrocketing and affordable properties are selling like hotcakes. It’s enough to deter any first home buyer into another ten years of renting – but it doesn’t have to.

For starters, the latest federal budget expanded on a bunch of incentives for first home buyers, making it slightly easier for newbies to enter the market. Secondly, Aussie Home Loans has launched a new tool to help. Here’s how it works.

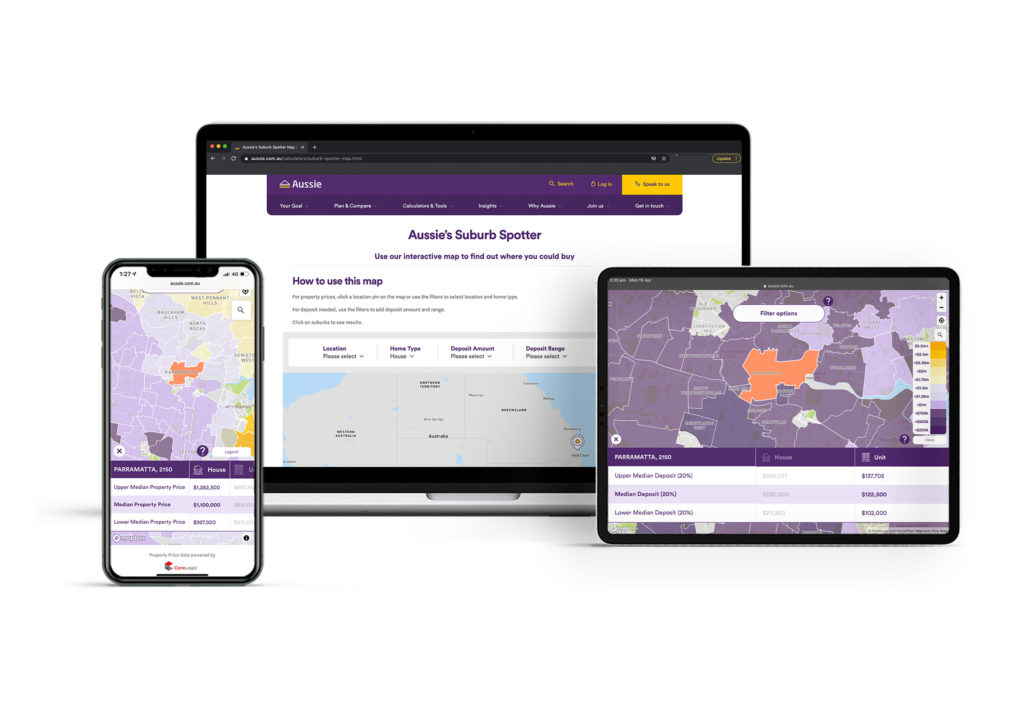

Aussie Suburb Spotter Map

Aussie Home Loans has launched a great tool to help home buyers connect with their dream properties. The Aussie Suburb Spotter Map is sure to be a godsend for anyone who has no idea where to even begin looking at property.

The interactive map draws on CoreLogic data and allows prospective home buyers to filter through suburbs based on median house prices, deposit requirements or targeted deposit savings.

You can check out the map here.

Once you’ve identified a suburb you can reasonably afford, you can get looking at listings!

Now you know where to look, but what do you need to consider before buying a property?

Tips for homebuyers

David Smith, CEO Lending, at Aussie Home Loans has shared with us some of his top tips for property buyers.

For starters, homebuyers should know what their end goal is. Smith says:

Before you start to look into purchasing a property, it’s important to set a clear goal for why you are purchasing it so, you can direct your search efforts. If you are not sure, check out different kinds of properties and even research around your desired locations to give you some direction.

He also said it’s important to understand your necessities and know where you can compromise.

Determining your wants versus your needs is crucial because you won’t always be able to find the perfect property. Consider what your necessities are for the property and the neighbourhood, what are the non-negotiables, and what you could compromise on. Things to consider include the number of bedrooms, school catchments, and public transport access. Also consider what you may need in the future if you plan on living in the property for a long time.

Smith also suggests you do your research and consider widening your search area – this is where the Suburb Spotter Map comes in.

“Researching the area that you want to buy in and inspecting as many properties as possible will help inform you with the values of properties in your preferred suburb or suburbs,” he said.

Now that you know where you want to live and how much you can pay, you need to broaden your calculations to include costs beyond the sale price.

The next step is to understand the amount you can borrow and more importantly can afford; as there are other costs to consider when purchasing a home like stamp duty, fees, and home loan repayments.

Smith suggests using an online home loan borrowing calculator or asking your broker. Knowing how much you can afford will help to tailor your search.

Finally, you’ve found that dream home, you’re ready to put your offer on the table, but you miss out because you weren’t pre-approved. Research suggests two in three homebuyers miss out on their desired properties because they weren’t ready.

For that reason, it’s important to seek pre-approval early on. Smith says:

As you begin to make some serious moves on your property search, you need to ensure you are ready to make offers when your dream property comes along. It takes time for lenders to assess home loan applications, so having pre-approval will allow you to confidently put in an offer or bid for a property.

Buying a home is a big step, and can seem like an overwhelming amount of work. But it’s worth it for your dream home, and hopefully, these tips and the new suburb spotter tool will help you along with the process.

Leave a Reply

You must be logged in to post a comment.